Autarky Grain Free Complete Variety Pack Adult Wet Dog Food - 12 x 395g

4.74 kg

In stockRegular price £19.71Unit priceChudleys Chicken Rich in Turkey with Liver Complete Wet Adult Working Dog - 12 x 395g

4.74 kg

Regular price £17.38Unit priceChudleys Rich in Beef & Chicken with Tripe Complete Wet Adult Working Dog - 12 x 395g

4.74 kg

In stockRegular price £17.38Unit priceChudleys Chicken Rich in White Fish Complete Wet Adult Working Dog - 12 x 395g

4.74 kg

Low stock (4 units)Regular price £17.38Unit priceChudleys Rich in Chicken & Beef with Lamb Complete Wet Adult Working Dog - 12 x 395g

4.74 kg

In stockRegular price £17.38Unit priceChudleys Complete Wet Adult Working Dog Variety Pack - 12 x 395g

4.74 kg

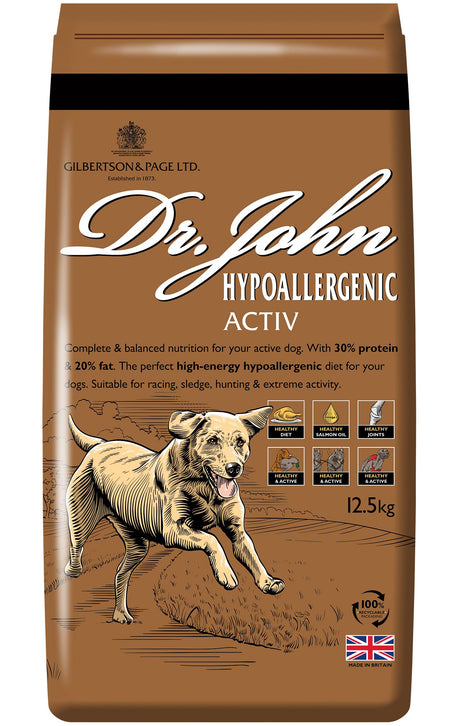

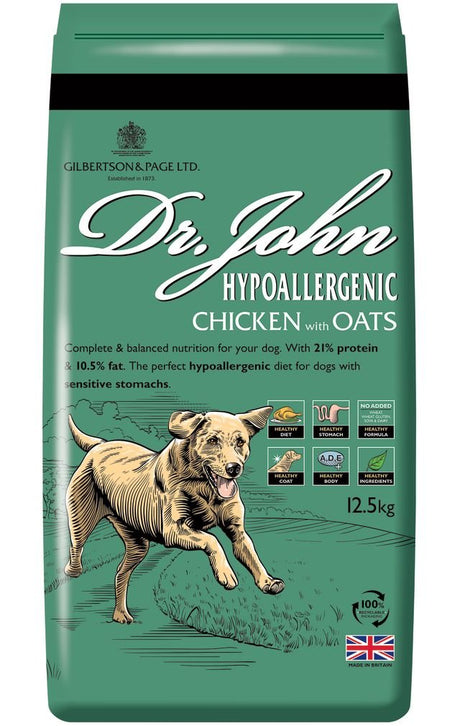

In stockRegular price £17.38Unit priceDr John Hypoallergenic Chicken with Oats Dry Dog Food

12.5 kg

In stockRegular price £20.81Unit priceAlpha Junior & Sporting with Chicken & Rice Dry Dog Food - 15 kg

15.0 kg

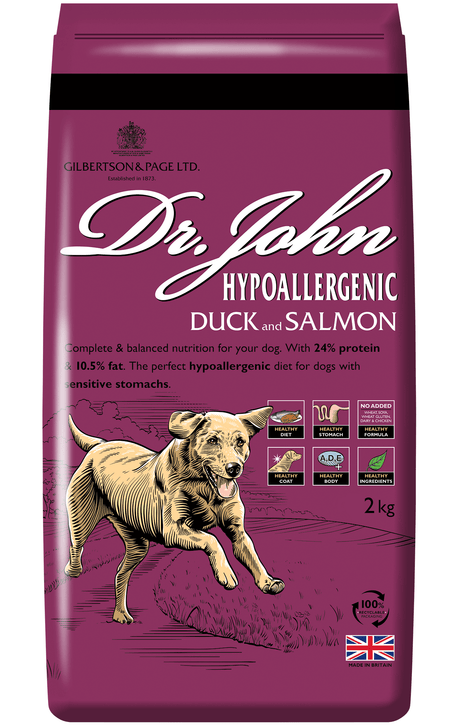

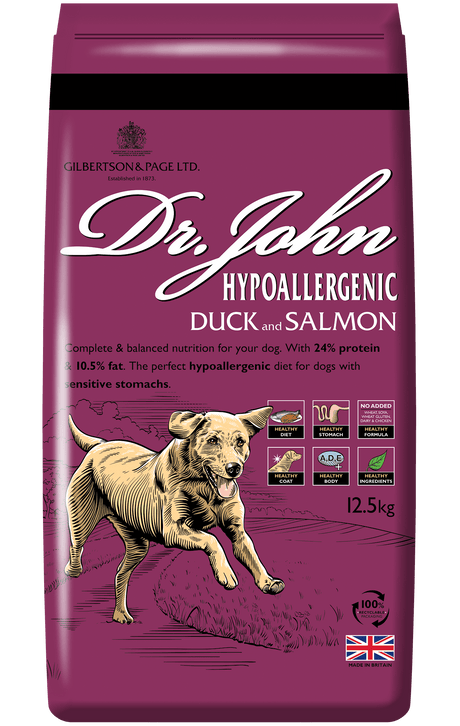

In stockRegular price £31.17Unit priceDr. John Hypoallergenic Duck and Salmon Dry Adult Dog Food

In stockRegular priceFrom £10.25Unit priceAutarky Senior Grain Free Tantalising Turkey Dry Dog Food

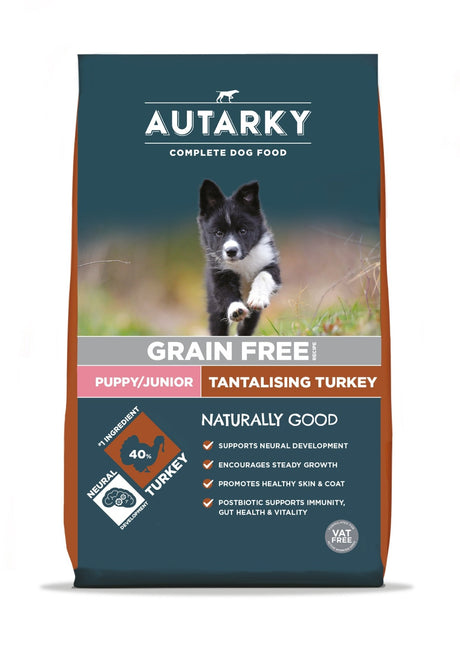

In stockRegular priceFrom £13.98Unit priceAutarky Puppy/Junior Grain Free Tantilising Turkey Dry Dog Food

In stockRegular priceFrom £13.98Unit priceVersele Laga Opti Life Adult Dog Active All Breeds Chicken Dry Food - 12.5kg

12.5 kg

Regular price £46.35Unit priceConnolly's Red Mills Engage Salmon & Rice Dog Food

Low stock (3 units)Regular priceFrom £14.34Unit priceAlpha Performance 30% Protein Adult Dry Dog Food - 15kg

15.0 kg

In stockRegular price £38.30Unit priceArkwrights Chicken & Beef 2x15 kg

30.0 kg

In stockSale price £31.95 Regular price £35.40Unit priceSkinners Field & Trial Puppy & Junior Chicken & Garden Veg Grain Free 18 x 390g

7.02 kg

Regular price £26.74Unit priceSkinners Field & Trial Adult Grain Free Salmon 18x390g

7.02 kg

Very low stock (1 unit)Regular price £26.75Unit priceSkinners Field & Trial Grain Free Lamb with Root Veg - 18 x 390g

7.02 kg

Very low stock (2 units)Regular price £26.74Unit priceSkinners Field & Trial Adult Grain Free Chicken 18x390g

7.02 kg

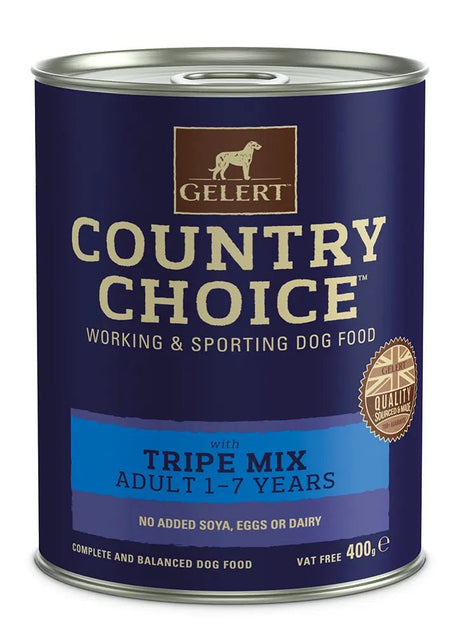

In stockRegular price £26.75Unit priceGelert Country Choice Adult Dog Tripe Variety Dog Food 12x400g

4.8 kg

In stockRegular price £13.30Unit priceGelert Country Choice Adult Dog Variety in Jelly Dog Food 6x1200g

7.2 kg

In stockRegular price £15.18Unit priceGelert Country Choice Variety Pack in Jelly Dog Food Tins 12x400g

4.8 kg

In stockRegular price £12.55Unit price